Pay yourself forward

Topping up your super early will help you get one step closer to ensuring you achieve your lifestyle goals for your post-work years. Now is the time to plan ahead and work out how much money you’ll need to fund the retirement lifestyle you want, and how much super you’ll need to get there.

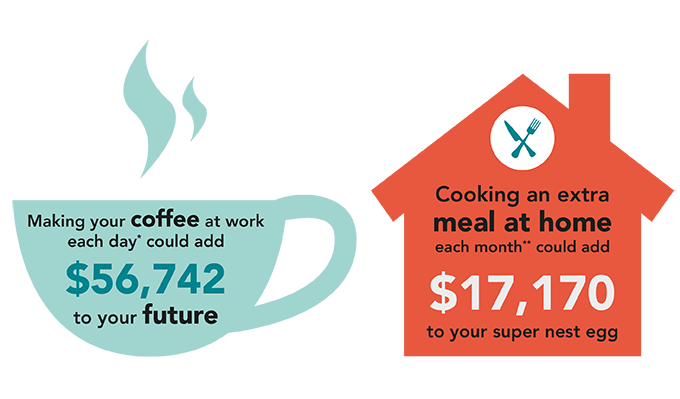

It’s the small things

We’re ‘supervening’ – give your future self a bonus

What type of lifestyle do you envision?

According to the Association of Superannuation Funds of Australia’s Retirement Standard, to have a ‘comfortable’ retirement, single people will need $595,000 in retirement savings, and couples will need $690,000.

The differences between a comfortable lifestyle in retirement and a more modest one can be vast, and the age Pension alone presents a very difficult tale. Thinking ahead now and boosting your super could change your future reality.

| |

Comfortable retirement |

Modest retirement |

Age Pension |

|

One annual holiday in Australia. |

One or two short breaks in Australia near where you live each year |

Even shorter breaks or day trips in your own city |

|

Regularly eat out at restaurants. Good range and quality of food |

Infrequently eat out at restaurants that have cheap food. Cheaper and less food than a ‘comfortable’ lifestyle standard |

Only club special meals or inexpensive takeaway

|

|

Owning a reasonable car |

Owning an older, less reliable car |

No car or, if you have a car, it will be a struggle to afford repairs |

|

Good clothes |

Reasonable clothes |

Basic clothes |

|

Take part in a range of regular leisure activities |

Take part in one paid leisure activity infrequently. Some trips to the cinema |

Only taking part in no cost or very low cost leisure activities. Rare trips to the cinema |

|

Private health insurance |

Private health insurance |

No private health insurance |

Boost your super now

To find out how much extra super you could get by making extra contributions, use our ‘Small change, big savings calculator’.

To contribute more to your super, contact your super fund today or speak to your employer.

*Calculation made using superguru.com.au calculator and based on a 30-year-old person putting an additional $116 each month into their super account, assuming 4.8%pa growth over 37 years.

**Calculation made using superguru.com.au calculator and based on a 30-year-old person putting an additional $35 each month into their super account, assuming 4.8%pa growth over 37 years.

†Calculation made using superguru.com.au calculator and based on a 35-year-old person putting an additional $10 each week into their super account, assuming 4.8%pa growth over 32 years. They do not take your personal circumstances into account and are not intended to be a substitute for professional advice. We make no warranties as to their accuracy and shall not be responsible for any action taken on the basis of the calculator. While such material is published with necessary permission, no supporter entity (or their related bodies) accepts responsibility for the accuracy or completeness of, or endorses any such material. Except where contrary to law, we intend by this notice to exclude liability for this material.