After-tax (non-concessional) contributions

After-tax contributions (non-concessional contributions) are contributions you make from your take-home pay. So if you find yourself with a little spare money that you would like to add to your retirement savings, you can contact your fund to find out how you can deposit this money into your super account. Some funds let you deposit the money straight from your bank account into your super account. To find how you make an after-tax contribution, contact your fund.

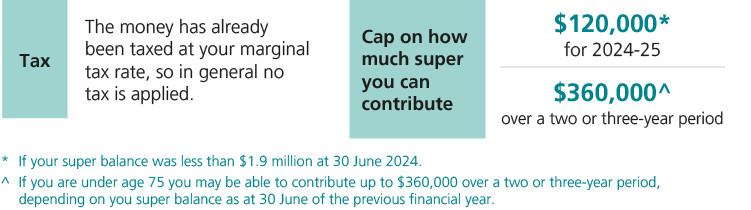

Non-concessional contributions

For more information on super tax concessions, download our factsheet.

Contribution caps for super

A ‘contributions cap’ is the maximum amount you can contribute to your super each financial year. If you contribute above the cap, you may have to pay extra tax. The cap amount and the extra tax you need to pay depend on whether the contributions are concessional (before tax) or non-concessional (after tax). For more information, see our Contribution caps page.

Claiming a tax deduction means your contribution is no longer ‘after-tax’

Since 1 July 2017 it has been possible for many people to claim a tax deduction for their personal superannuation contributions, even if their employer is already making Super Guarantee contributions for them.

If you claim a tax deduction for your personal contribution, you need to be aware that it will change from an after-tax (non-concessional) contribution to a before-tax (concessional) contribution and will be counted against your concessional contributions cap for the year.

Before you can claim a deduction you must give your fund a notice in a special format and within a strict deadline. Some other conditions also apply – for more information, visit the ATO website or contact your fund.