Before-tax (concessional) contributions

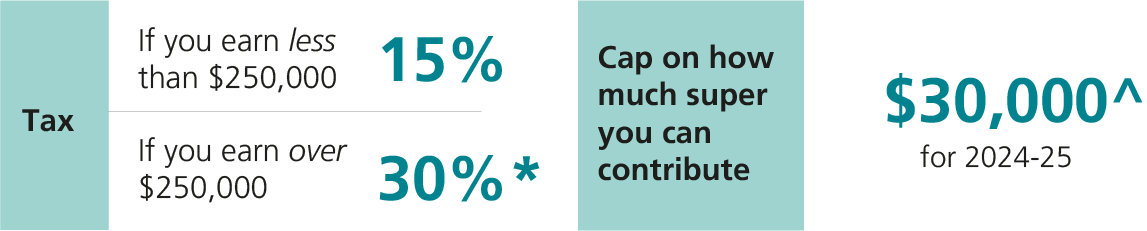

Before-tax contributions are often referred to as ‘concessional contributions’ while after-tax contributions are sometimes referred to as ‘non-concessional contributions’. They are both taxed differently.

Concessional contributions

Concessional contributions include compulsory Super Guarantee contributions made by your employer and your salary sacrifice contributions. If you make personal contributions to your fund from your after-tax income and then claim the contributions as a tax deduction, these will also be converted into concessional contributions.

* When working out what rate of tax you will pay on your concessional contributions, the ATO uses a special expanded definition of ‘income’. The 30% tax rate may not apply to all of your concessional contributions. The exact calculation is quite complex – for more information, go to the ATO website.

^ If your total super balance was less than $500,000 as at 30 June 2024 and your concessional contributions in 2023-24 were less than that year's cap of $27,500 you may be able to ‘carry forward’ any unused part of the cap to use within the next five years.

For more information on super tax concessions, download our factsheet.