Have you thought about the type of lifestyle you want in retirement?

It’s probably not something that crosses your mind every day, but small changes you make now can have a huge impact in future. That’s why we’re partnering with Money to launch Super Booster Day and make it easier for you to contribute a little extra to your super.

In order to have a ‘comfortable’ retirement, single people will need $545,000 in retirement savings, and couples will need $640,000 (according to the ASFA Retirement Standard).

Grow your super!

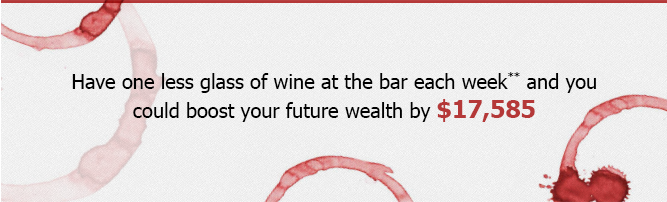

Super Booster Day encourages you to pledge to make extra contributions to your super. Even small amounts set aside can make a huge difference over the long term. For example, if you’re 30, preparing an extra meal at home each month* could increase your future wealth by $38,796. Super Booster Day is 15 September every year. So, pay yourself forward!

For more information on how much super you’ll need for a comfortable lifestyle, click here.

To contribute more to your super, contact your super fund today or speak to your employer.

*Calculation made using superguru.com.au calculator and based on a 30-year-old person putting an additional $35 each month into their super account, assuming 5%pa growth over 35 years. **Calculation made using superguru.com.au calculator and based on a 45-year-old person putting an additional $43 each month ($10 per week) into their super account, assuming 5%pa growth over 20 years. †Calculation made using superguru.com.au calculator and based on a 35-year-old person putting an additional $43 each month($10 per week) into their super account, assuming 5%pa growth over 30 years. ††Calculation made using superguru.com.au calculator and based on a 25-year-old person putting an additional $30 each month into their super account, assuming 5%pa growth over 40 years. The figures provided by the calculator are based on a series of assumptions and are general illustrations only.They do not take your personal circumstances into account and are not intended to be a substitute for professional advice. We make no warranties as to their accuracy and shall not be responsible for any action taken on the basis of the calculator. While such material is published with necessary permission, no supporter entity (or their related bodies) accepts responsibility for the accuracy or completeness of, or endorses any such material. Except where contrary to law, we intend by this notice to exclude liability for this material.