What is super?

Superannuation (also called ‘super’) is money for your retirement. You build up super while you are working to make sure you can have a comfortable retirement. Australia has a compulsory system of superannuation, which means the money for your retirement comes mostly from compulsory super contributions that your employer pays into your super fund. By law, your employer has to pay a specific percentage of your salary into your super fund. This is called the Superannuation Guarantee. Usually, you can’t get this money until you retire.

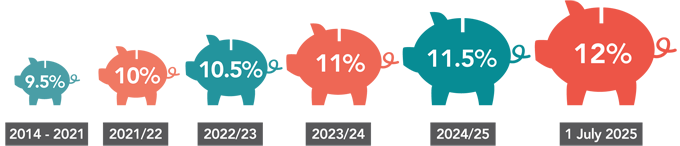

The Superannuation Guarantee rate is being raised gradually to 12 per cent. The rate is 11.5 per cent from 1 July 2024, and it will increase to 12 per cent from 1 July 2025.

You can also make extra voluntary before or after tax contributions to help grow your super savings. The government also offers a co-contribution scheme to help build your balance. For more information, see our Making contributions section.

Am I eligible for super?

Most people working in Australia are entitled to be paid super by their employer. This means your employer has to pay a minimum of 11.5% of your salary (from 1 July 2024) into your super fund if:

- you’re over 18

- you’re under 18 and work 30 or more hours a week.

It doesn’t matter if you’re working full time, part time or casually – if you meet the above criteria, you should receive SG contributions from your employer.

For more information see How does super work?